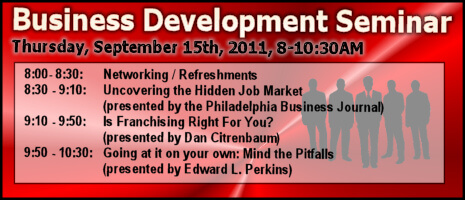

Gibson & Perkins, P.C invites you to join us at our Media, PA office on Thursday, September 15th, from 8:00-10:30AM as we welcome the Philadelphia Business Journal for a live seminar. Firm partner Edward L. Perkins joins the Journal’s Brian Wiggins and entrepreneurial guru Dan Citrenbaum for an introduction on starting your own business, or for those […]

Category Archives: Blog

Individuals can correct mistakes made on federal tax returns through the process of amending those returns. This week, our tax newsletter which is circulated to tax advisors and clients includes ten facts from the Internal Revenue Service about amending your federal tax return: The facts you will learn include: When to amend a return When […]

Our latest tax letter, this time detailing the recent developments regarding Form 8939 and the estate tax, is now online. IRS Finally Sets Due Date for Form 8939 and Issues Revised 706 This complementary download should be considered alongside Notice 2011-66 (which provides guidance for executors of estates of decedents who died in 2010 regarding […]

Our latest tax letter details the most important tax developments that have occurred in the past three months that may affect you, your family, your investments, and your livelihood. A thorough review of this letter is highly recommended — there are wide-ranging implications that may affect the methods employed by your accounting or legal practice, […]

Gibson & Perkins, P.C. is pleased to share with you our newest publication, “Your Appeal Rights Before the Internal Revenue Service.” Prepared by our Tax Department: Edward L. Perkins, BA, JD, LLM (Tax), Walter J. Timby, III, JD, LLM (Tax) and Peter J. Bietz, JD, LLM (Tax), this publication outlines IRS Publication 556 in considerable […]

Gibson & Perkins, P.C. is pleased to share with you a “First Year Checklist for a New Business in Pennsylvania.” Written by Edward L. Perkins, BA, JD, LLM (Tax), CPA, this publication is a must-read for individuals thinking about creating their own business in Pennsylvania; or for those who have recently done so. Click Here […]

Gibson & Perkins, P.C. is pleased to share with you a new publication entitled “Buy-Sell Basics: An Overview of the Fundamentals of Buy-Sell Agreements.” Written by Edward L. Perkins, BA, JD, LLM (Tax), CPA, this publication should be considered essential reading for attorneys drafting buy-sell agreements and the certified public accountants (and similar financial professionals) who review […]

Recently published in the Pennsylvania Bar Association Quarterly digest, this article offers an in-depth look at some of the obvious (and less-than-obvious) mistakes being made by estate planning attorneys today. Click Here or the Image to the Right to View This material is also available as both a CPE program for accountants and a […]

Firm partner Edward L. Perkins is proud to announce an upcoming appearance discussing “Common Estate Planning Blunders and How To Avoid Them.” On Friday, July 15th, 2011, Mr. Perkins will appear at the Llanerch Country Club in Havertown, PA, located just outside of Philadelphia. The presentation will begin promptly at 8:15AM, and provide an in-depth […]